ESG reporting: standards and helpful software tools

25 Apr 2024 • 15 min read

Marcin Kulawik

The environmental, social, and governance (ESG) reporting landscape is undergoing a significant transformation in 2024. With stricter regulations emerging worldwide and investors increasingly prioritizing ESG performance, companies can no longer afford to lag behind. This surge in interest is evident not just in loan products, but across all investment strategies.

This article will guide you through the evolving ESG reporting landscape, explain key standards, and introduce helpful software tools to streamline your reporting process.

The importance of ESG for businesses and investors

In today's world, ESG considerations are no longer a niche concern, but a central pillar of responsible business practices and informed investment strategies.

For investors, ESG frameworks offer a powerful lens to assess a company's alignment with their values and long-term goals. These frameworks go beyond traditional financial metrics, providing insights into critical areas like:

- Environmental stewardship: This includes a company's approach to climate change mitigation, resource use, and waste management.

- Social responsibility: Investors can evaluate a company's commitment to fair labor practices, diversity and inclusion, and community engagement.

- Strong governance: ESG frameworks assess the quality of a company's leadership, board composition, and risk management practices.

This comprehensive analysis allows investors to make informed decisions that align with their values and prioritize long-term company sustainability.

Furthermore, the benefits of ESG extend beyond the realm of investment. By prioritizing ESG factors, companies demonstrate their commitment to responsible practices, potentially improving brand reputation, attracting and retaining talent, and mitigating environmental and social risks. These factors can ultimately translate to enhanced financial performance and long-term resilience.

What is ESG reporting

ESG reporting is the process by which companies disclose information about their environmental, social, and governance practices. This information is typically presented in formal reports, sustainability reports, or dedicated ESG reports, and can also be integrated into financial statements. The core purpose? Transparency. By disclosing ESG data, companies offer stakeholders, especially investors, a clear view of their performance, commitments, and progress towards sustainability goals. This transparency fosters investor understanding and encourages responsible practices across the corporate world. ESG reporting also serves as a catalyst for positive change by inspiring other organizations to benchmark their own ESG performance and adopt best practices.

Here's what this means in simpler terms: companies are increasingly opening up about their impact on the environment, their social responsibility practices, and how they're governed. ESG reporting allows them to share this information with investors and other stakeholders in a clear and consistent way. This transparency benefits everyone – investors gain valuable insights, companies can inspire positive change, and ultimately, the environment and society benefit from more responsible business practices.

Navigating the ESG Reporting Landscape: Frameworks vs. Standards

Understanding the distinction between ESG frameworks and standards is crucial when navigating the evolving ESG reporting landscape.

- ESG Frameworks: Think of a framework as a roadmap. It provides a broad set of principles that guide and shape the understanding of ESG reporting. Frameworks offer direction but don't dictate specific methodologies for collecting data or producing reports. They're valuable tools, especially when a well-defined standard isn't yet available.

- ESG Standards: Standards, on the other hand, are much more specific. They provide detailed criteria that clearly outline what needs to be reported. Imagine them as a set of instructions – they dictate how information and data should be collected, reported, and which topics or business areas need to be included. By establishing consistent and reliable disclosure practices, standards make ESG frameworks more actionable.

In essence, frameworks provide the "why" and "what" of ESG reporting, while standards offer the specific "how." They work together to ensure comprehensive and transparent ESG disclosures.

ESG Frameworks types

There are three main categories of ESG frameworks, each serving a distinct purpose:

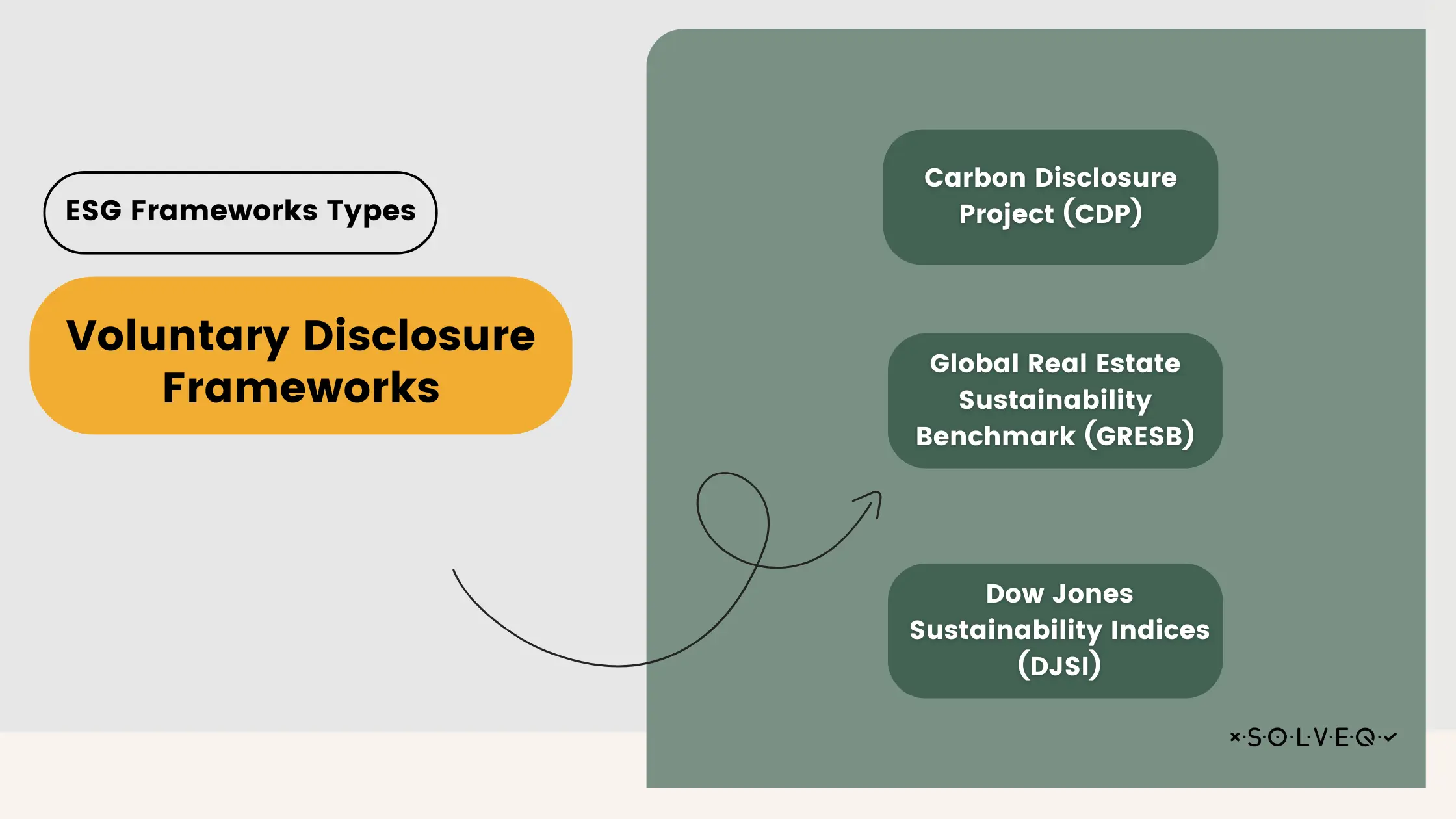

Voluntary disclosure frameworks

Companies proactively share information on their sustainability efforts, policies, performance data, and other ESG-related details through these frameworks. Often taking the form of questionnaires, these frameworks provide transparency and allow for benchmarking against industry peers. Popular examples include:

- Carbon Disclosure Project (CDP): Focuses on greenhouse gas emissions, water security, and environmental performance.

- Global Real Estate Sustainability Benchmark (GRESB): Specific to real estate, collecting data on buildings within portfolios.

- Dow Jones Sustainability Indices (DJSI): Another real estate-focused framework with publicly available results.

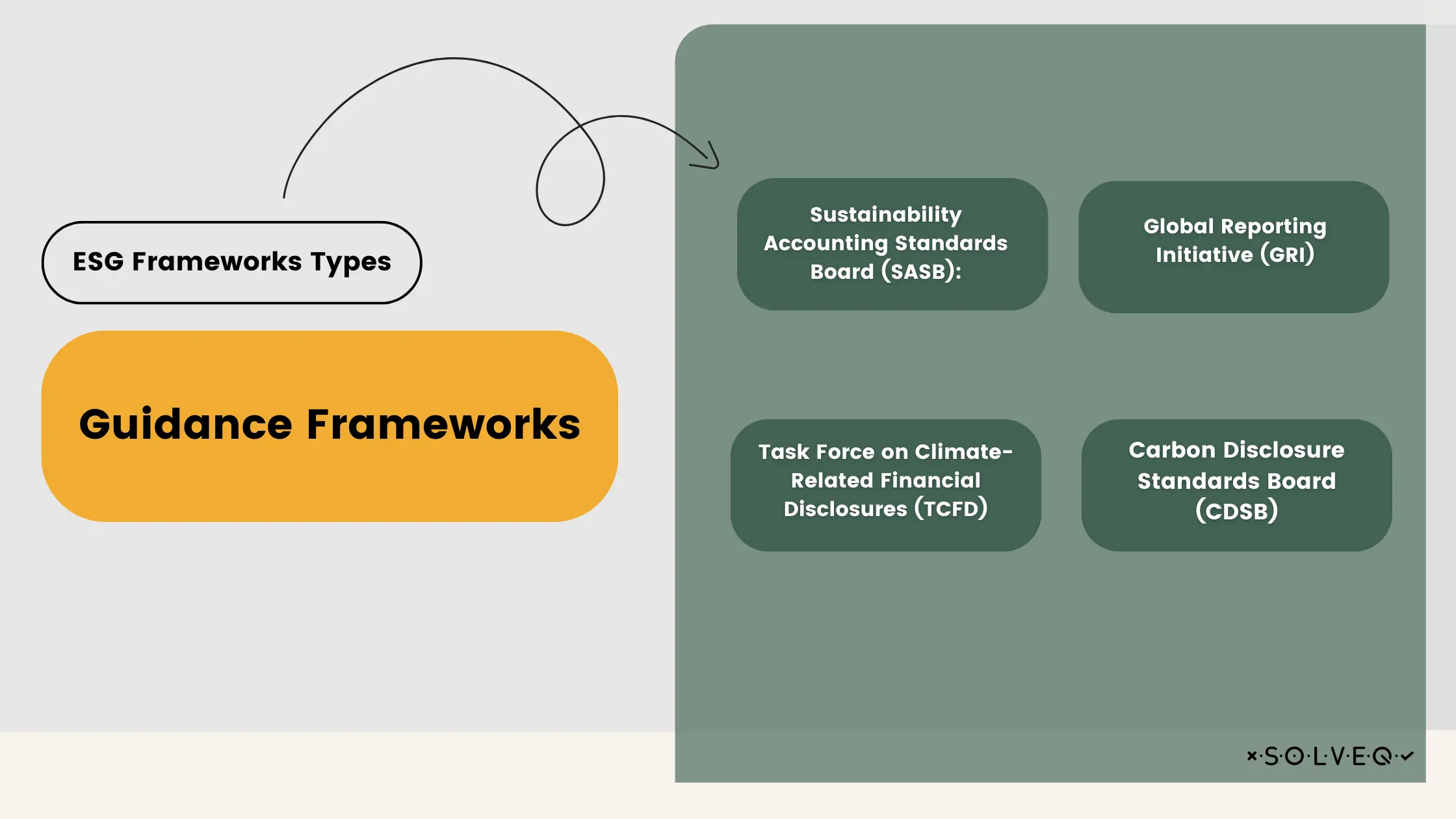

Guidance frameworks

These offer recommended methodologies and best practices to help companies identify, manage, and report on their ESG performance. They don't dictate specifics but provide valuable guidance. Here are some prominent examples:

- Sustainability Accounting Standards Board (SASB): Focuses on financial information related to ESG issues for investors.

- Global Reporting Initiative (GRI): Covers a broad range of ESG topics with universal, sector-specific, and topic-specific standards companies can choose from.

- Task Force on Climate-Related Financial Disclosures (TCFD): Provides recommendations for voluntary disclosures on climate-related risks.

- Carbon Disclosure Standards Board (CDSB): An initiative of the CDP, focusing on standardizing environmental information reporting and its impact on finances.

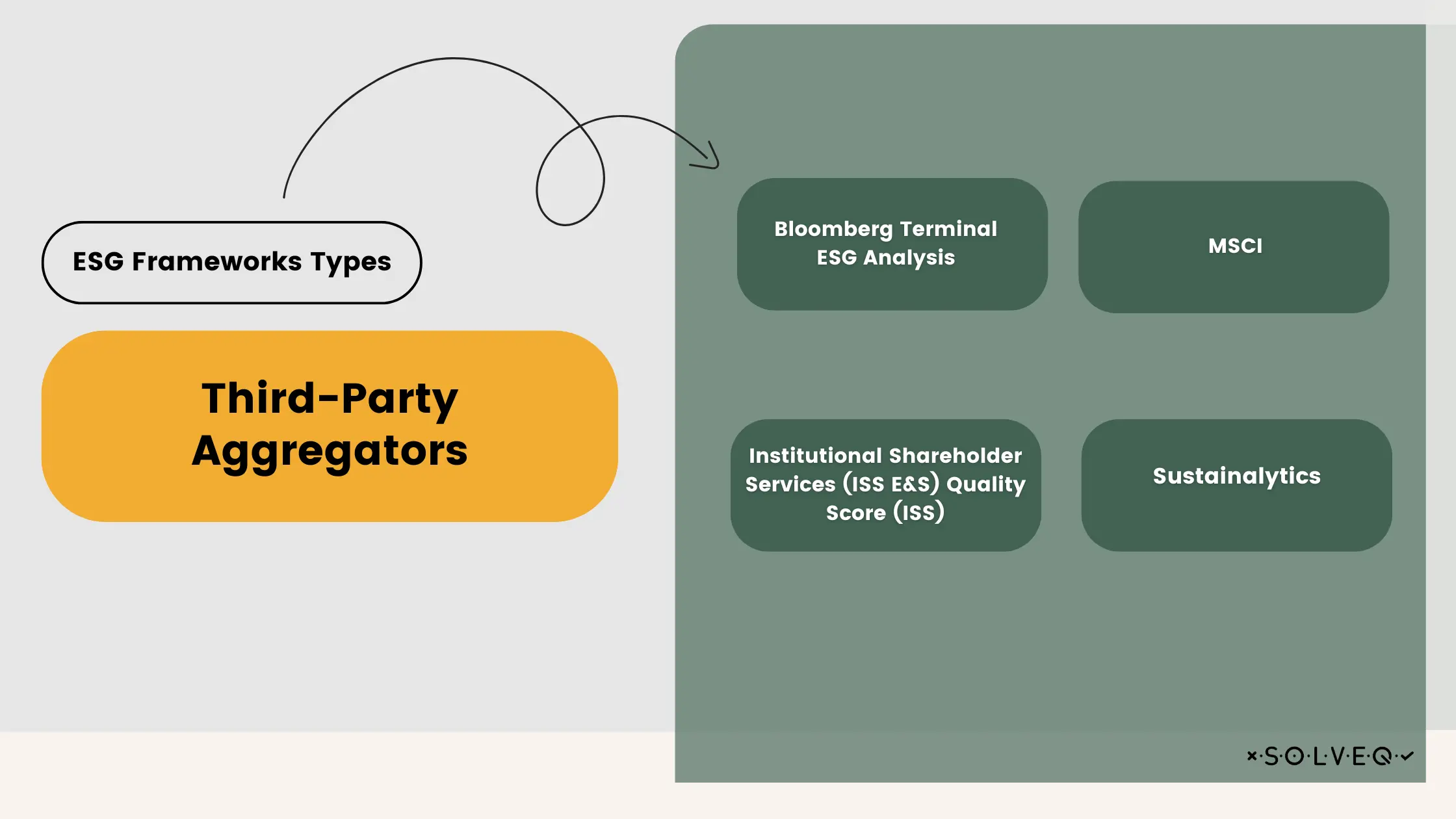

Third-party aggregators

These don't require companies to actively participate but instead assess performance based on publicly available data like reports, filings, and websites. Some key players include:

- Bloomberg Terminal ESG Analysis: Requires a subscription but uses public information to assess a company's ESG performance.

- Institutional Shareholder Services (ISS E&S) Quality Score (ISS): Analyzes publicly available information and provides a sustainability rating.

- MSCI: Aggregates data from various sources to demonstrate a company's exposure to ESG risks and its industry ranking. Requires a subscription.

- Sustainalytics: Analyzes company data from public sources and media reports to assess ESG performance.

Understanding these different types of frameworks helps companies choose the right approach for their ESG reporting needs.

Navigating the ESG Reporting Challenge Course

While ESG reporting offers significant benefits, it's not without its hurdles. Understanding these challenges can help you make informed decisions when implementing ESG practices and minimize potential roadblocks:

Standardization Maze

There's currently no single, universally accepted standard for ESG reporting. This can be confusing, as different frameworks like TCFD, SASB, GRI, CDP, and GRESB have varying data requirements. Companies need to conduct thorough research and define their goals to choose the most suitable framework(s).

Evolving Landscape

The sustainability reporting landscape is constantly in flux. Political and regulatory changes can lead to frequent updates and revisions in reporting rules. Keeping pace with these changes and ensuring compliance can be a challenge, potentially resulting in penalties for non-compliance.

Data Hurdles

Data collection is a significant hurdle for many organizations. The lack of a standardized approach makes it difficult to ensure data accuracy and completeness. While tools like the GHG Protocol exist, uncertainties around measurement processes and reporting methodologies can lead to potential inaccuracies.

Greenwashing Concerns

The lack of clear standards and data challenges can increase the risk of greenwashing. This occurs when companies prioritize meeting minimal compliance requirements rather than setting ambitious sustainability goals and implementing impactful initiatives. Greenwashing results in misleading or superficial disclosures that don't reflect genuine progress towards sustainability objectives.

Political and Social Debates

ESG reporting has faced criticism from both sides of the political spectrum. Some argue that ESG metrics are not financially relevant and create unnecessary investment risks, while others view it as a distraction from traditional economic growth. These differing perspectives and political dynamics can further complicate the sustainability reporting landscape.

By acknowledging these challenges, companies can develop a more strategic approach to ESG reporting, ensuring transparency, minimizing risks, and maximizing the positive impact of their sustainability efforts.

The Power of Carbon Footprint Reporting

Measuring and managing an organization's carbon footprint is a cornerstone of any modern sustainability strategy. It's a crucial step on the path to achieving net-zero emissions and combating climate change.

A carbon footprint report goes beyond basic calculations. It's a comprehensive assessment that quantifies all greenhouse gas (GHG) emissions generated by the organization, including:

- Direct emissions: Those arising directly from an organization's operations (e.g., on-site fuel combustion, company vehicles).

- Indirect emissions: Emissions occurring upstream and downstream in the supply chain (e.g., purchased goods and services, transportation of materials).

By pinpointing emission hotspots across the entire value chain, these reports empower companies to:

- Assess climate risks and opportunities: Understanding emission sources allows companies to identify areas for improvement and potential cost savings associated with enhanced efficiency.

- Inform and guide sustainability efforts: Data from carbon footprint reports forms the basis of effective sustainability strategies and goal-setting.

- Demonstrate accountability: Reporting carbon footprint publicly showcases a company's commitment to environmental responsibility and progress towards sustainability objectives.

This transparency benefits both businesses and stakeholders. Companies benefit from informed decision-making, while stakeholders gain a clear picture of the organization's environmental impact and commitment to a sustainable future.

How can ESG Sofware help companies & investors?

ESG reporting software has become an indispensable tool for both companies and investors navigating the evolving landscape of sustainability. Let's explore how it empowers each group:

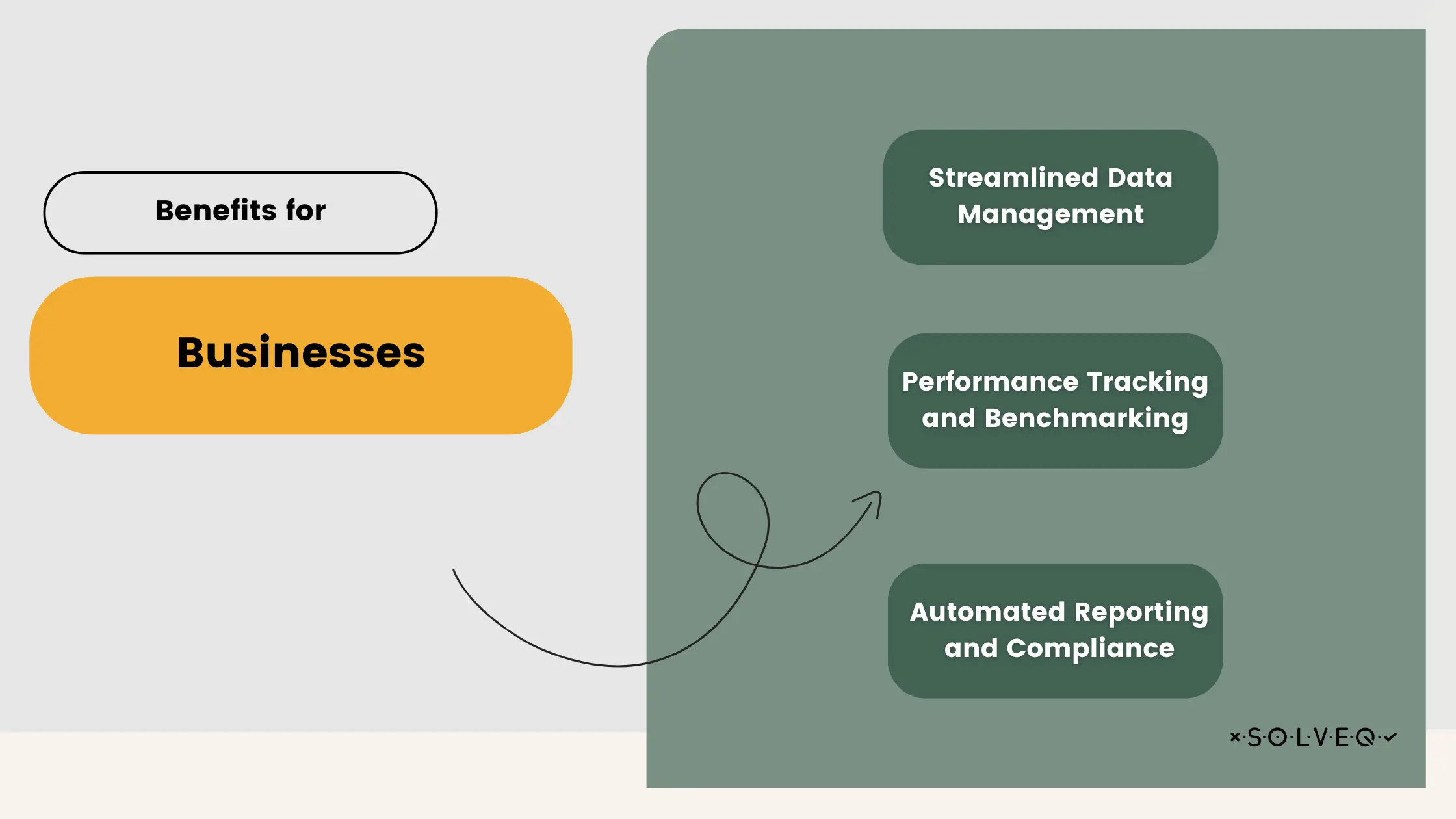

Benefits for Businesses:

- Streamlined Data Management: ESG software simplifies the often-complex process of collecting vast amounts of ESG data from various sources. This streamlines data gathering and analysis, saving time and resources.

- Performance Tracking and Benchmarking: Gain valuable insights by tracking progress over time and benchmarking performance against industry peers. Identify areas needing improvement and set actionable goals for continuous improvement.

- Automated Reporting and Compliance: Eliminate manual processes and human error with automated report generation. Ensure compliance with evolving reporting requirements for greater efficiency and peace of mind.

Improved Transparency and Stakeholder Engagement: Demonstrate your commitment to ESG principles by creating clear, consistent, and transparent reports that can be easily shared with stakeholders.

Benefits for Investors:

- ESG Risk Screening and Identification: Software helps pinpoint companies with potential ESG risks (e.g., environmental pollution, labor practices). This allows for informed investment decisions and portfolio diversification.

- ESG Leader Identification: Easily identify companies leading the pack in ESG performance. Allocate investments strategically and capitalize on opportunities presented by sustainable businesses.

- Portfolio ESG Performance Tracking: Gain valuable insights into the overall ESG performance of your entire portfolio. Track progress over time and adjust investment strategies accordingly.

- Sustainability Claims Validation and Controversy Detection: Software can help verify the validity of sustainability claims made by companies and identify potential controversies. This saves time and effort in further due diligence.

2024 Software Landscape Examples

The ESG software market continues to evolve rapidly. Here are a few prominent examples offering solutions in 2024:

For a deeper dive into their specific strengths, consider reading our article on Top Sustainability Management Tools in 2024.

Summary

New EU regulations are pushing companies to prioritize sustainability. ESG reporting emerges as a critical tool, offering a framework for transparency on environmental, social, and governance practices. This focus on resource use, carbon footprint, and responsible business conduct aligns perfectly with stakeholder concerns. While navigating frameworks and challenges can be complex, mastering ESG reporting empowers businesses to not only build trust and enhance reputation, but also ensure compliance with upcoming regulations. Ultimately, it's a win-win for businesses and the environment.

Share:

Looking for expert development team?

Schedule a call with Tech Consultant

Marcin Kulawik

Founder and CEO of SolveQ. Huge fan of building things with purpose, agility, and having fun while changing the World. Loves his family, teammates, and nature.