The Hidden ROI of ESG: Why Sustainability Is Smart Business

14 May 2024 • 8 min read

Marcin Kulawik

Many people, upon hearing about ESG and the upcoming regulations in 2024, might immediately think of higher costs, restrictions, and overall struggles. But hold on! These concerns are just one side of the story. ESG can actually bring a ton of good to your company!

With the deadline for mandatory ESG reporting for large companies approaching next year (as outlined in the EU's Corporate Sustainability Reporting Directive), it's a great time to take a proactive approach and use this as an opportunity. Here at SolveQ, we're experts in ESG, and we've packed this article with all the hidden and surprising benefits of embracing ESG reporting in your company!

ESG Requirements: EU and Worldwide

Let's dive into the specifics of ESG regulations, starting with the European Union (EU) which is currently at the forefront. The EU has implemented the Corporate Sustainability Reporting Directive (CSRD), which sets a phased timeline for mandatory ESG reporting:

- Large companies (with more than 500 employees) became subject to the CSRD on January 1, 2024. This means they need to track and collect ESG data for the 2024 financial year, with their first report due in 2025.

- The CSRD expands its reach in 2026. Companies meeting two out of three criteria (250 employees, €50 million in turnover, or €25 million in total assets) will need to comply.

It's important to note that while the EU is a leader, the trend of mandatory and standardized ESG reporting is gaining momentum worldwide. We can expect to see similar regulations emerge in other regions in the coming years.

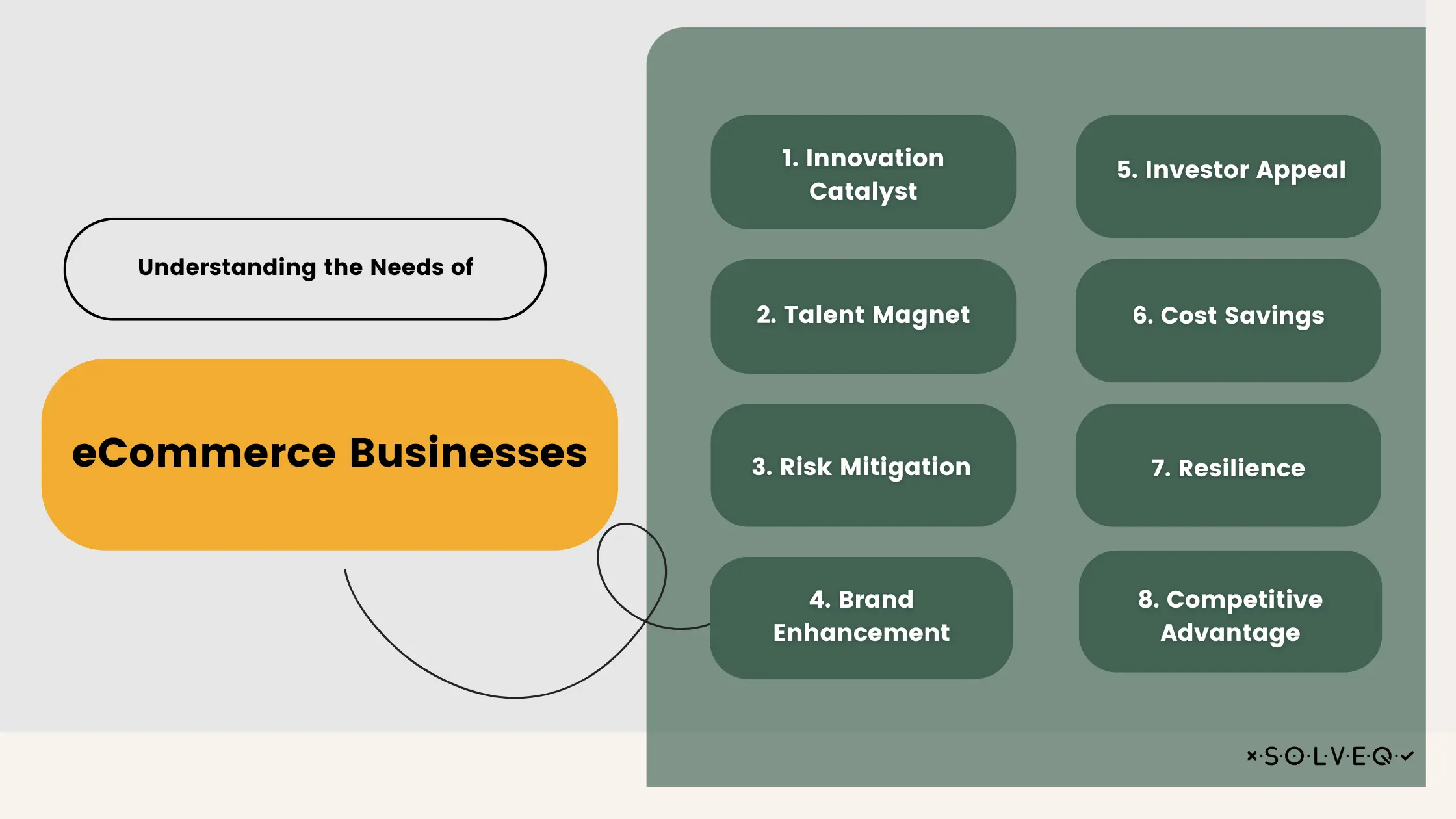

Unexpected Benefits of ESG: Turning Compliance into a Competitive Edge

While ESG regulations might seem like an added burden, they can actually unlock a treasure trove of hidden benefits for your company. Here's how embracing ESG can transform compliance into a strategic advantage:

1. Innovation Catalyst

ESG concerns often push companies to rethink traditional processes and explore new ways to operate. This can lead to a surge of innovation, resulting in the development of new products, services, or more efficient operations. For example, a company focused on reducing its carbon footprint might develop a revolutionary energy-saving technology in the process.

2. Talent Magnet

Younger generations are increasingly seeking purpose-driven employers with strong ESG values. By demonstrating your commitment to sustainability and social responsibility, you can attract and retain top talent who share your vision. This creates a more engaged and motivated workforce, ultimately driving better business outcomes.

3. Risk Mitigation

ESG analysis is like a financial x-ray for your company. It helps identify and manage hidden risks related to environmental disasters, social unrest, or poor governance. By proactively addressing these issues, you can prevent disruptions to your business operations and ensure long-term stability.

4. Brand Enhancement

Consumers are increasingly making purchasing decisions based on a company's ESG practices. A strong ESG reputation leads to a positive brand image, fostering customer loyalty and trust. Additionally, positive media coverage can further enhance your brand awareness and reputation.

5. Investor Appeal

The investment landscape is changing. Investors are increasingly prioritizing ESG factors when making investment decisions. By demonstrating strong ESG practices, you make your company more attractive to environmentally and socially conscious investors, increasing your access to capital.

6. Cost Savings

ESG isn't just about "doing good" for the environment and society, it's also good for your bottom line. Energy efficiency measures, waste reduction practices, and responsible resource management can lead to significant cost savings over time. This frees up resources to invest in other areas of your business.

7. Resilience

Companies with strong ESG practices are often better equipped to weather economic downturns or other crises. Their commitment to sustainability ensures responsible resource management, strong employee relations, and a positive public image – all of which contribute to a company's overall resilience.

8. Competitive Advantage

In today's crowded markets, ESG can be a powerful differentiator. By showcasing your commitment to sustainability and social responsibility, you can stand out from your competitors and attract customers who value these factors. This can give you a significant edge in the marketplace.

By embracing ESG, you can transform compliance into a strategic advantage. The hidden benefits of ESG can unlock innovation, attract top talent, improve brand reputation, and ultimately create a more resilient and successful business.

Benefits for Investors: Unveiling ESG's Hidden Gems

For startups and companies seeking funding, a strong ESG focus can be a game-changer. Here's how embracing ESG can make you a more attractive investment opportunity:

Investor Alignment

Today's investors are increasingly prioritizing ESG factors alongside traditional financial metrics. By demonstrating a commitment to sustainability and social responsibility, you align your values with those of a growing pool of environmentally and socially conscious investors. This can unlock access to a wider range of funding sources.

Reduced Risk Profile

ESG analysis helps identify and manage environmental, social, and governance risks that could impact your business. By proactively addressing these risks, you demonstrate a commitment to long-term sustainability and responsible growth, making your company a less risky investment proposition.

Enhanced Brand Reputation

A strong ESG reputation fosters positive brand perception and consumer trust. This can attract a wider customer base and boost your overall market potential, making your business a more attractive investment in the eyes of investors.

Future-Proofing Your Business

ESG considerations are becoming increasingly integrated into regulations and consumer preferences. By prioritizing ESG from the outset, you future-proof your business and ensure its long-term viability in a rapidly evolving market landscape. This positions you for sustainable growth and increases your attractiveness to investors seeking long-term returns.

Impact Investing Appeal

If your business directly addresses environmental or social challenges, your ESG focus can resonate with impact investors. These investors prioritize positive social and environmental impact alongside financial returns. Demonstrating a strong ESG alignment can unlock access to this growing pool of capital.

By integrating ESG principles into your company's DNA, you demonstrate a commitment to responsible growth and a sustainable future. This not only benefits the environment and society but also positions your company for success and makes you a more compelling investment opportunity.

Summary

ESG regulations might seem daunting, but they unlock a treasure trove of hidden benefits for your company. From attracting top talent and boosting brand reputation to reducing costs and gaining a competitive edge, ESG can be a strategic advantage. Investors are increasingly prioritizing ESG, making a strong ESG focus crucial for startups seeking funding. Ready to unlock the power of ESG? SolveQ offers expert ESG consultations and custom solutions to help your company thrive in the new sustainability landscape.

Share:

Looking for expert development team?

Schedule a call with Tech Consultant

Marcin Kulawik

Founder and CEO of SolveQ. Huge fan of building things with purpose, agility, and having fun while changing the World. Loves his family, teammates, and nature.