ESG for wishy-washy: misconceptions and objections

24 May 2024 • 8 min read

Marcin Kulawik

ESG has become a hot topic, but is it just a fad for businesses? Concerns about cost, complexity, and keeping up with ever-changing standards are valid. This article dives deeper, unpacking the truth behind these concerns and revealing the hidden benefits of ESG practices. Discover how ESG reporting can transform your company into a more resilient, competitive, and future-proof organization.

What is ESG and Why Is It So Popular?

Ever heard the term ESG but unsure exactly what it means? You're not alone. ESG stands for Environmental, Social, and Governance. It's a framework for companies to consider the impact their business has on the planet, their employees, and how they're run. Lately, there's been a growing focus on ESG investing, where investors take these factors into account alongside traditional financial metrics.

The deadlines you might be hearing about are new regulations or reporting requirements being implemented by various countries and organizations. These deadlines aim to standardize how companies disclose their ESG performance, making it easier for investors to understand their sustainability efforts. While the specific deadlines may vary depending on location and industry, it's clear that ESG is becoming increasingly important for businesses of all sizes.

Beyond the Hype: Debunking Common ESG Concerns for Businesses

We've established that ESG (Environmental, Social, and Governance) is more than just a buzzword, and upcoming deadlines underscore its growing importance. But for many businesses, implementing ESG practices can feel like navigating uncharted territory. Let's address some of the most common concerns business owners have about ESG and shed light on the reality behind them.

1. New Rules, Uncertain Benefits

New ESG regulations and reporting requirements seem complex and time-consuming. What's the payoff for my business?

While navigating new regulations can feel daunting, strong ESG practices can actually save you money in the long run. Here's how: reduced energy consumption, waste minimization, and efficient resource management all lead to cost savings. Additionally, focusing on ESG can attract and retain top talent who value sustainability, reducing turnover costs.

2. Focus on Feel-Good Factors, Ignoring Profits

Some might say ESG is just about "feeling good" and doesn't translate to real profits. Is that true?

Strong ESG practices are not about sacrificing profits. In fact, companies with a focus on sustainability are often better equipped to manage risks. Think about potential environmental regulations, resource scarcity, or even customer backlash for poor social practices. Strong ESG helps mitigate these risks, promoting long-term stability for your business.

3.Standards Keep Changing

It seems like the bar for ESG keeps rising. How can my company keep up with ever-evolving expectations?

A rising bar for ESG shouldn't be seen as a burden. It pushes companies to continuously improve their sustainability efforts, which ultimately benefits everyone. Investors increasingly view strong ESG practices as a sign of a company's commitment to responsible practices and resilience in the face of future challenges. This can make your company more attractive to potential partners and investors.

4. Potential Greenwashing accusations

If I focus on ESG, there's a risk of greenwashing accusations - making misleading claims about sustainability efforts. This could damage my company's reputation if exposed. How do I avoid this?

Transparency is the key here. The best way to avoid greenwashing is by being transparent about your ESG efforts. Focus on concrete actions you're taking and set realistic goals for improvement. Third-party verification of your ESG performance can also add credibility. Remember, genuine commitment to sustainability is the best defense against greenwashing accusations.

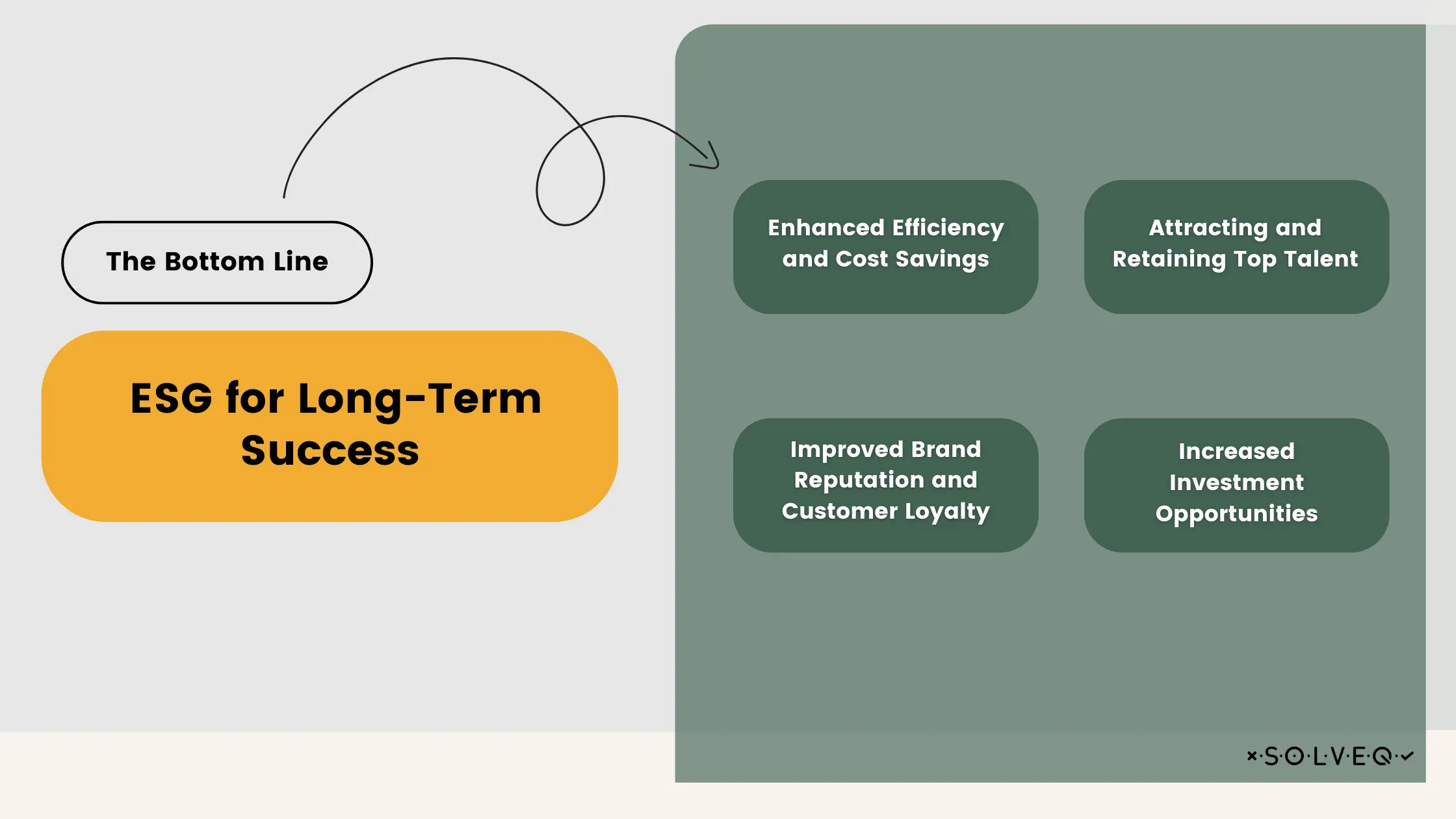

The Bottom Line: ESG for Long-Term Success

While there may be initial hurdles, ESG offers a clear path to long-term success for your business. By focusing on responsible environmental practices, fostering a positive social impact, and implementing good governance, you can create a more resilient and competitive company. ESG isn't just a fad; it's a strategic approach to building a sustainable future for your business and the world around it. To illustrate this better see what are its main benefits:

1. Enhanced Efficiency and Cost Savings

- Reduced Operational Costs: ESG reporting encourages a closer look at resource usage (energy, water, materials). This often leads to identifying areas for improvement, translating to lower operating costs in the long run.

- Risk Management and Mitigation: ESG reporting helps identify and address environmental and social risks before they escalate. This could be anything from potential regulatory fines for pollution to employee safety hazards. Proactive risk management saves money and protects your company's reputation.

2. Improved Brand Reputation and Customer Loyalty

- Stronger Brand Image: Consumers are increasingly conscious of a company's social and environmental impact. A strong ESG profile shows your commitment to sustainability, which can enhance your brand image and attract customers who share your values.

- Increased Customer Loyalty: Customers are more likely to be loyal to brands they perceive as responsible. ESG reporting demonstrates your commitment to doing good, fostering trust and loyalty from your customer base.

3. Attracting and Retaining Top Talent

- Engaged Workforce: Employees today value working for companies with strong ESG practices. ESG reporting demonstrates your commitment to a positive work environment, social responsibility, and sustainability, which can attract and retain top talent.

- Improved Employee Morale: When employees feel their company is making a positive impact, it can boost morale and productivity. Strong ESG practices contribute to a better work environment for everyone.

4. Increased Investment Opportunities

- Access to Capital: Investors are increasingly seeking companies with strong ESG practices. ESG reporting can make your company more attractive to investors seeking sustainable investments, opening doors to new funding opportunities.

Overall, ESG reporting isn't just about compliance with upcoming deadlines; it's a strategic approach to building a more resilient and competitive business. It can lead to significant cost savings, enhance your brand reputation, attract top talent, and open doors to new investments. If you want to discover more hidden benefits that ESG reporting brings be sure to read our latest article on Why Sustainability Is Smart Business

Summary

ESG concerns can feel overwhelming for businesses, but the reality is clear: strong ESG practices benefit your bottom line. From reduced costs and risk mitigation to attracting top talent and loyal customers, ESG reporting is a strategic investment in your company's future. Don't wait for deadlines to hit – take the first step towards a more sustainable and successful business by exploring how ESG reporting can work for you.

Share:

Looking for expert development team?

Schedule a call with Tech Consultant

Marcin Kulawik

Founder and CEO of SolveQ. Huge fan of building things with purpose, agility, and having fun while changing the World. Loves his family, teammates, and nature.